Legally watertight archiving

nscale enables compliant digital archiving.

Audit-proof storage of digital documents

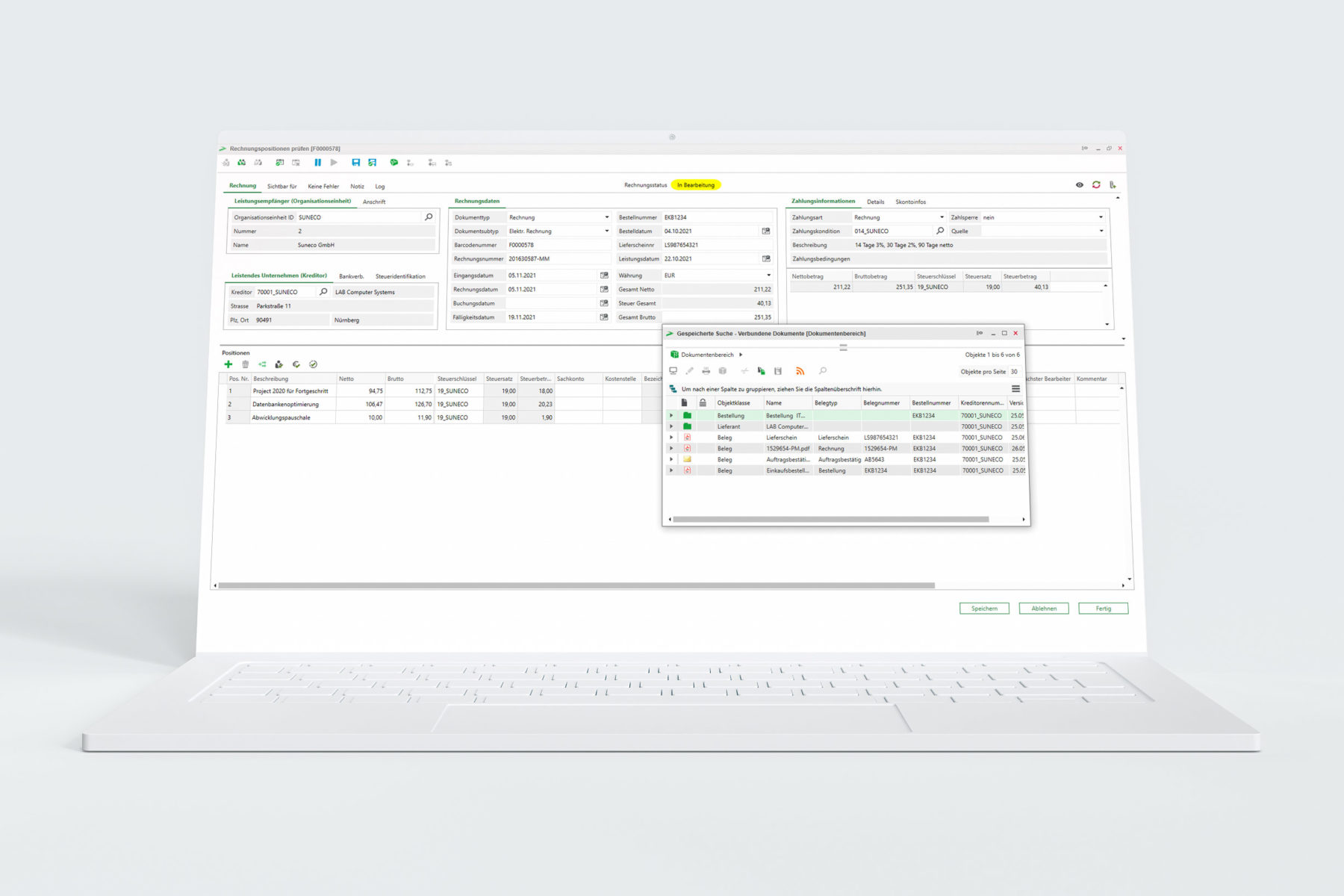

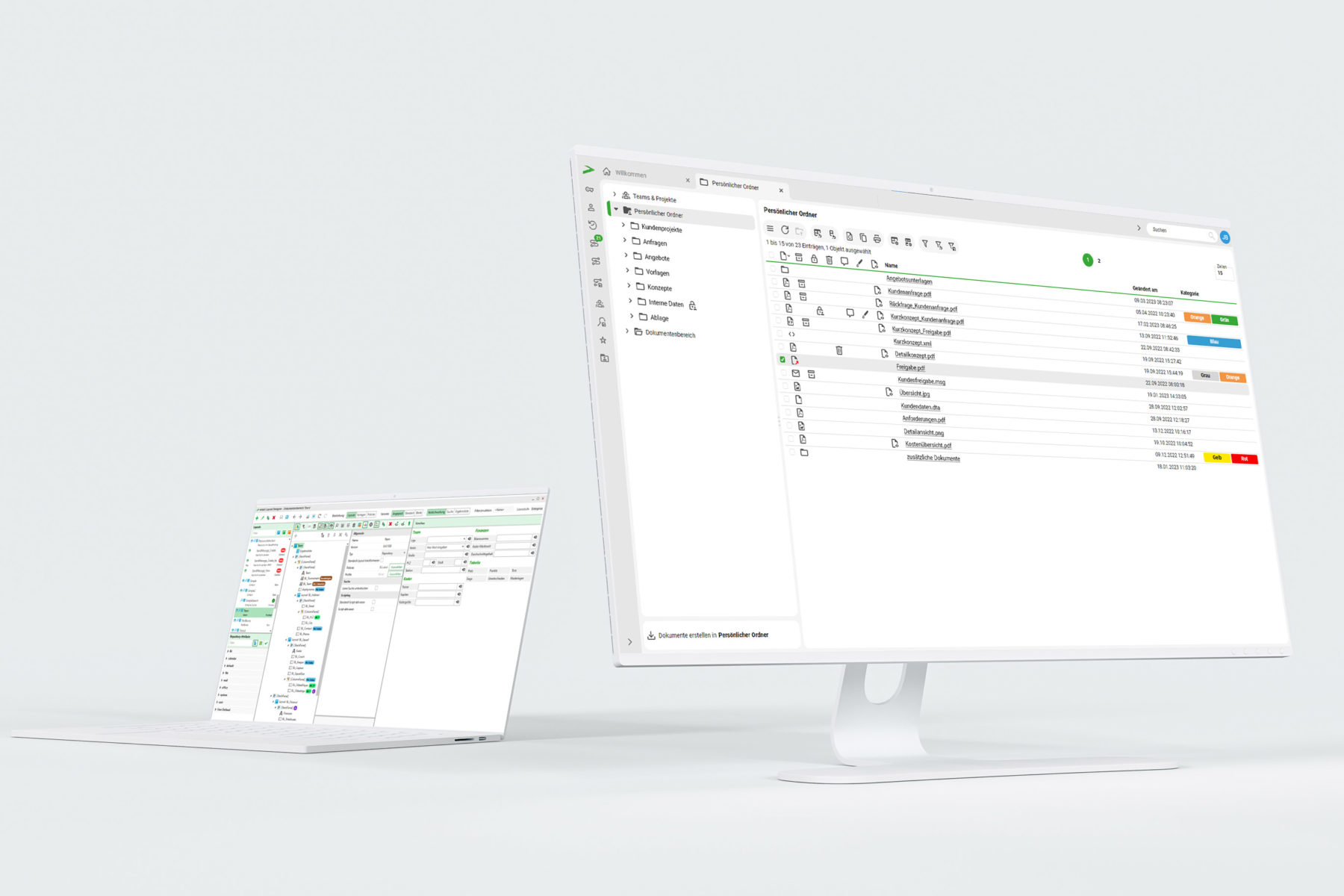

Advancing digitalisation and the electronic document processing that comes with it offer numerous advantages for companies – from cost savings to increased efficiency and even greater transparency. If you want to exploit all this potential, you need to adhere to various statutory requirements. When paper documents are scanned in, they need to be stored in an audit-proof way. This is guaranteed if, when the document is finally stored, there is no way that it can be lost or changed. The nscale storage layer helps you meet these requirements – and forms the central interface to all storage systems.

The nscale server storage layer manages the physical storage of the document on the storage medium. The data objects you need – however many that is – are accepted and labelled with a unique document ID, which can be used to access the original document at any time. It does not matter on which storage backend the data is stored, or with what additional processing – the user can access the information they want at any time. With the nscale server storage layer, different storage media can also be managed for archiving in parallel. The nscale server storage layer offers certified standard connectors to many storage systems (e.g. NetApp, EMC, AMAZON S3, Hitachi).

Single instance process

Digital fingerprints or storage using a single instance process can also be added easily at any time, preventing duplicate storage of documents on the storage layer. The user does not see any of this, as the nscale server storage layer organises the process automatically The storage space needed reduces automatically.

Retention periods and regulations regarding evidential value and trustworthiness also apply to electronic documents. In the most extreme cases, you are required to retain documents for more than 100 years – even digital ones. The files have to remain accessible at all times, with neither their integrity nor their authenticity threatened. It is a task that should not be underestimated and presents many companies with enormous challenges. You can define retention and deletion periods centrally for document types and files in the nscale server storage layer Any retention period of your choice can be modelled in the software. If the storage medium also supports retention periods (e.g. NetApp or EMC), you can also set these.

Retention and deletion periods

The storage layer makes legally watertight archiving easy

Imagine the archive in the storage layer like a cloakroom: you hand a document in to the system and receive a ticket – a unique ID – in return. When you want to access the document again later, you enter the ID in the system and are given your archived document back. It is a simple principle that makes archive technology platform-independent due to numerous interfaces. It can work on a range of operating systems (e.g. Microsoft Windows, Linux, IBM AIX) to suit your requirements. Using the open system architecture, we have integrated new storage systems for you again and again over the years. In addition, the storage layer can easily be connected to products from large manufacturers such as IBM, EMC and NetApp.

The nscale storage layer means that legally watertight archiving is no longer a problem.

nscale uses the storage layer for your archiving tasks

As well as being extremely fast and providing reliable transparency, the storage layer has impressed with its outstanding migration options ever since it was introduced in 1989. Simple, traceable documentation ensures that your archiving remains consistent at all times, even when you switch systems. Forming the technological basis of the solution portfolio surrounding the nscale information platform, the storage layer is ideally set up for the challenges of the future. nscale’s open architecture and enormous adaptability offer the ideal conditions for integrating modern technologies and cloud use. You get your archiving fit for the future and benefit from a reliable, proven solution.

- Openness

- Simplicity

- Speed

- Legal compliance

- Adaptability

Your benefits at a glance

- High security of investment

- Constant further development and adaptation to current technologies

- Compliant and audit-proof long-term archiving in line with TR-ESOR

- Simple archiving of emails and CAD data

- Smooth exchange of data and documents from SAP systems via the ArchiveLink interface

- Support of various storage adapters

- Compression, encryption, single instance

Want to know more?

- Whitepaper